The Financial Wellness Subcommittee is a collaborative effort through several departments here at UNH. We know there are a lot of costs to attending college beyond tuition, such as housing, basic food and hygiene needs, textbooks, transportation and more. Additionally, the financial aid process is detailed and complicated, especially student loans. We aim to demystify the finances of the college experience and aid students in building the skills necessary for life-long financial success.

UNH Basic Needs Initiative Committee: Financial Wellness Subcommittee

- Jes Crowell, Director, TRIO Scholars

- Elizabeth Fowler, Assistant Professor, User Engagement and Student Success Librarian, UNH Library

- Kathleen Grace-Bishop, Director, Health & Wellness Education & Promotion

- Patty Mathison, Basic Needs Coordinator and Case Manager

- Heather Morris, Project Coordinator, Institute on Disability

- Dawna Perez, Executive Director, Student Success

- Shari Robinson, Assistant Vice President, Student Life

- Karen Spiller, Thomas W Haas Professor in Sustainable Food Systems

What is Financial Wellness? Measure your Financial Wellbeing

Financial Literacy Resource Guide (UNH Library)

This financial literacy resource guide on the UNH Library website offers many digital resources to support students and their financial wellness. This resource guide includes general information on finances as well as UNH resources with videos, books, articles and other tools to help build your financial knowledge and confidence.

Financial Literacy Resource Guide

Topics include:

- Paying for College

Budgeting

Savings & Investing - Credit & Debt

Insurance

Resources for Educators

Consumer Financial Protection Bureau Resources

Your Money, Your Goals: A financial empowerment toolkit

The Consumer Financial Protection Bureau's toolkit is comprehensive and brings together information, tools, and links to other resources you can use to build skills in managing money, credit, debt, and financial products. Having all these resources in one place can make it easier for you to bring financial empowerment concepts into conversations you may already be having.

- • Set goals and calculate how much money you need to save to reach these goals

- • Plan for large purchases and life events

- • Learn to effectively save money

- • Establish an emergency savings fund

- • Get tax refunds and put the funds toward achieving your goals

- • Track the specific ways you are using your money

- • Bring your cash flow budgets into balance

- • Make a simple plan to pay down debt

- • Get, review, and fix errors on your credit reports

- • Evaluate financial products and services

- • Learn how to protect yourself from identity theft and fraud

Visit the Consumer Financial Protection Bureau's toolkit to learn more

UNH Health and Wellness: Financial Wellness

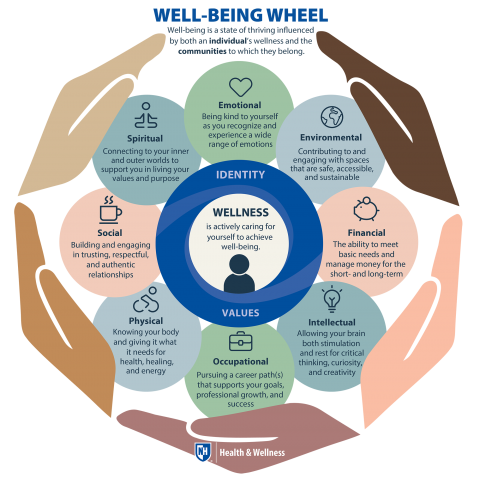

UNH Health and wellness: Well-being wheel

UNH Health and wellness: Well-being wheel

Financial wellness is the ability to meet basic needs and manage money for the short- and long-term.

As you look at the Wheel, you can ask yourself: How can I align my values with my choices? How do my identities, strengths, and experiences affect my wellness? How is my community supporting my wellness? How am I contributing to others’ wellness?

Signs of Financial Wellness

- Learning how to manage your money and establishing a personal budget

- Not living beyond your means

- Making a plan to pay back your student loans

- Learning about debt and how to manage it

- Building good credit

- Thinking long term, e.g., setting up a savings account, setting up investments, and/or a retirement account

- Learning not to let money be the driving force of your life or an indication of your self-worth

- Donating some of your money, if possible, to a cause you believe in

Check-in with your financial wellness:

- How does money impact your emotional wellness?

- Do you know how to manage your money so you know what you have and don't have?

- Are you able to pay tuition and additional school expenses? If not, do you know where to go for help?

- Do you have spending money saved so that you can get off campus and explore the local area?

- Will you need to find a job on or off campus?

- Are you thinking about a plan to pay back your student loans?

Request a Financial Wellness Program

Are You on the Right Cash Course? Many college students have minimal skills in managing their money and debt. The CASH (Create a Savings Habit) program gives an excellent overview of budgeting, saving, debt, and money management.

Request Financial wellness workshop

Talk to a Wellness Educator/Counselor

UNH students can make individual appointments with a wellness educator/counselor to discuss financial wellness. Call (603) 862-3823 or make an appointment online.