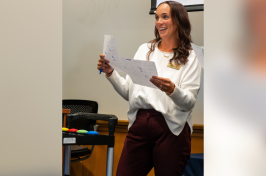

Research from Inchan Kim, an assistant professor of business administration at the UNH Peter T. Paul College of Business and Economics, found the DEI initiatives focused on social groups with perceived diminishing support during a U.S. presidency can lead to higher stock prices.

Focusing corporate diversity, equity and inclusion (DEI) initiatives on social groups with perceived diminishing support during a U.S. presidency can lead to higher stock prices, according to research from the University of New Hampshire Peter T. Paul College of Business and Economics.

In a study scheduled for publication in November’s Journal of Business Research, Inchan Kim, an assistant professor of business administration at Paul College, and his former research assistant Brandon McNeil ’20, researched the stock prices of financial services firms listed in the Fortune 1000 when they were supporting DEI initiatives for LGBT groups and military veterans during the presidencies of Barack Obama and Donald Trump.

The research found that DEI initiatives supporting LGBT groups corresponded with higher stock returns during Trump's presidency, when LGBT rights faced less support and bold rhetoric, as opposed to Obama's presidency, when LGBT rights were supported.

Conversely, DEI initiatives aimed at veterans generated higher stock returns during Obama's presidency, when the administration dealt with military budget cuts placed on them as part of a debt ceiling negotiation, as opposed to during the Trump presidency, when a lot of those military budget restrictions were reversed.

DEI initiatives were identified through an analysis of tweets from financial services firms listed in the Fortune 1000. The researchers manually categorized these tweets and used artificial intelligence to zero in on DEI initiatives aimed at veterans and LGBT groups. Cumulative abnormal returns (CARs) were calculated to gauge the influence of DEI initiatives on stock prices, considering various time windows around the publication of DEI-related tweets.

Kim hypothesized going into the study that DEI initiatives targeted at groups could lead to higher stock prices during a presidency when that group faces increased political opposition compared to periods when they enjoy political support.

“I was thinking to myself, in general, people are good, and I was sure that people tend to like companies that take care of those vulnerable groups, especially when their liberties are undermined,” Kim says.

However, what was surprising was that DEI initiatives aimed at LGBT groups during the Obama administration resulted in negative stock prices for companies, while DEI for veterans during the Trump administration resulted in little stock price change.

“What I expected was no stock changes during the supportive administration, but we found that DEI for LGBT resulted in negative reactions to stock prices during the Obama administration, which was a supportive administration,” Kim says.

Kim theorized that DEI initiatives focused on veterans may be easier for companies to justify at any time, while supporting LGBT groups can still be a very polarizing issue to some, resulting in companies being more strategic about that support.

Under Obama’s administration, companies with DEI for veterans saw their stocks increase by 0.65%, while companies with DEI for LGBT groups saw their stocks decrease by 0.34%, according to the study. Under Trump’s administration, companies with DEI for veterans saw their stocks increase by 0.09%, while companies with DEI for LGBT saw their stocks increase by 0.24%.

Overall, the stock price increase for companies with DEI initiatives focused on veterans during Obama's presidency was 0.56 percentage points higher than during Trump's presidency, while the stock price increase for companies with DEI initiatives focused on LGBT groups during Trump's presidency was 0.58 percentage points higher than during Obama's presidency, according to the study.

Some examples of DEI initiatives for veterans included donations to veteran groups and veteran hiring initiatives. Initiatives focused on LGBT groups included companies voicing public statements of support on LGBT-related issues and highlighting initiatives aimed at creating an inclusive workforce.

The Obama and Trump administrations were chosen for the study because they represented opposite political ideologies. The study took a narrow time frame into account, focusing on the last 500 days of Obama's presidency and the first 500 days of Trump's presidency to mitigate potential confounding variables.

Kim conducted the study to encourage businesses to participate in DEI initiatives while showing when they can be the most effective.

“I’m interested in how to encourage companies to do the right thing and as we know it’s a capitalist society and one of the best ways to encourage companies to do the right thing is to demonstrate how their socially responsible actions matter financially,” Kim says. “After all, companies have a fiduciary duty to shareholders and stakeholders, and their resources are limited, so they need to use their resources in a non-wasteful way.”

Companies should continue to invest in DEI initiatives but should also be aware of which social groups are perceived to lack political support, according to Kim.

“Companies can’t thrive without engaging in socially responsible issues, I think they just have to be smart about it. If they don’t, they will likely face a competitive disadvantage,” Kim says. “According to these findings, companies that help social groups when their liberties are under attack can get rewarded financially in stock prices, but it’s also useful to understand when DEI doesn’t help their financial situations.”

Future research in this area could explore smaller firms and other industries, according to Kim. Kim is also interested in studying how leading companies engage in DEI initiatives to identify trends other companies could follow.

-

Written By:

Aaron Sanborn | Peter T. Paul College of Business and Economics | aaron.sanborn@unh.edu