UNH Economists Submit U.S. Supreme Court Brief Opposing Internet Sales Tax Effort

DURHAM, N.H. - Two economists at the University of New Hampshire have submitted an amicus brief to the U.S. Supreme Court in support of an effort by Overstock.com and Amazon.com to halt a New York state Internet sales tax effort.

Neil Niman, chair of the UNH Department of Economics and associate professor of economics, and Richard England, professor of economics, both at the UNH Peter T. Paul College of Business and Economics, submitted the amicus brief in support of a petition for writ of certiorari by Overstock.com and Amazon.com. The two large Internet retailers have asked the U.S. Supreme Court to review a New York state appeals court decision that forces them to collect sales taxes if they utilize New York based affiliates to help advertise their products.

According to the UNH economists, the New York sales tax effort is detrimental for a number of reasons. First, it discourages Internet retailers from using affiliate marketing programs - hiring in-state marketers to promote and sell their products. This closes an important market entry point for new entrepreneurs, which dampens innovation and reduces competition and overall economic growth, which conflicts with the core purpose of the Commerce Clause in the U.S. Constitution.

"Many new businesses have innovative products that are just entering the market and have yet to gain a loyal following with consumers. Participating in an affiliate program enables such a business to generate much-needed revenue when it needs it most: when it is struggling to stay afloat long enough to develop a customer base," Niman and England say.

"Hence, the New York statute's economic disincentives on Internet retailers utilizing independent affiliates will likely reduce the introduction of desirable new products into the marketplace, making it more difficult for young entrepreneurs to bridge the gap between a promising concept and a profitable company," they say.

Second, the New York law imposes the same tax-collection duties on in-state physical retailers and out-of-state Internet retailers, which essentially subsidizes in-state physical retailers.

"Those with a physical presence in the state, especially traditional brick-and-mortar stores, reap substantial benefits from a whole host of government-provided goods and services: police and fire protection, public utilities and sewers, roads, parking spaces and structures, and many others. Many of these benefits are vital to the principal source of economic advantage associated with physical retailing - the ability of the customer to touch a good and immediately take it home upon purchase. The Internet retailer would bear all of the same burdens of collecting sales taxes as the retailer with a physical presence while receiving only a fraction, if any, of these benefits," Niman and England say.

Finally, the New York law eliminates the incentive for Internet retailers to remain physically absent from the state. Now that there is no incentive, the statute will spur Internet retailers to expand in-state warehouse and distribution networks, which will decrease delivery times and match more closely the immediacy of traditional brick-and-mortar retailing. This could erode the valuable public benefits that flow from physical retail spaces.

The economists explain that physical retail spaces have a positive impact on property values, generate higher tax revenues when shoppers take advantage of nearby businesses like restaurants, and draw tourists. However, as shopping has become more of a recreational and social activity - with consumers ordering items at home at a lower price online after window shopping in the physical store - physical retailers have found it more difficult to fully monetize the benefits they create.

"The New York statute and others like it may contribute to undermining the viability of many physical retailers, thus threatening a hollowing-out of the retail experience that disserves the public interest in maintaining a vibrant physical retail environment," the economists say.

The U.S. Supreme Court has not decided if it will hear the Overstock and Amazon case.

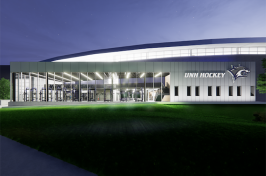

The UNH Peter T. Paul College of Business and Economics offers a full complement of high-quality programs in business, economics, accounting, finance, information systems management, entrepreneurship, marketing, and hospitality management. Programs are offered at the undergraduate, graduate, and executive development levels. The college is accredited by the Association to Advance Collegiate Schools of Business, the premier accrediting agency for business schools worldwide. For more information, visit paulcollege.unh.edu.

The University of New Hampshire, founded in 1866, is a world-class public research university with the feel of a New England liberal arts college. A land, sea, and space-grant university, UNH is the state's flagship public institution, enrolling 12,300 undergraduate and 2,200 graduate students.

-30-

UNH economist Neil Niman can be reached at neil.niman@unh.edu and 603-862-3336.

Latest News

-

July 2, 2024

-

June 18, 2024

-

June 18, 2024

-

May 17, 2024

-

May 14, 2024