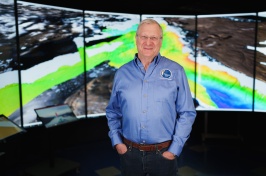

Assistant Professor of Finance ZhaoZhao He's most recent studies, The Exploratory Mindset and Corporate Innovation, appeared in the Journal of Financial and Quantitative Analysis after six years researching the long- and short-term financial success of firms alongside various traits of their CEO.

For Assistant Professor of Finance ZhaoZhao He, earning Paul College's Outstanding Researcher of the Year Award in 2020 was all about hard work. “I didn’t have much of a social life,” she jokes. But after seeing her paper in a renowned research journal and earning this prestigious award just six years after earning her Ph.D., she knows it was worth it. He holds the Virginia Paul Dee Professorship of Finance at Paul College, and her current research focuses on empirical corporate finance with specializations in corporate cash policy, innovation, labor mobility, and product market interactions.

|

| ZhaoZhao He, assistant professor of finance |

One of He’s most recent studies, The Exploratory Mindset and Corporate Innovation, appeared in the Journal of Financial and Quantitative Analysis after six years researching the long- and short-term financial success of firms alongside various traits of their CEO. Characteristics such as whether or not the CEO had a Ph.D., invested in human capital and research and development (R&D), and if she or he prioritized immediate stock value or long-term expenditure were explored.

A finding from He’s research revealed that, on average, CEOs who invested primarily in R&D saw less immediate profit but had more long-term financial success than CEOs who invested little in R&D. Investing in human capital was also determined as critical to a firm’s long-term success.

He and her research partner, David Hirshleifer, professor of finance at University of California-Irvine, focused on traits that suggest managerial “short-termism”–a more astute way of referring to CEOs who prioritize short-term success over long-term success.

The key variables in the study included “innovation variables” such as the number of patents, citation counts, generality, originality, patent value, and within a company. “Firm performance variables” focused on return on assets, number of alliances, and market-adjusted returns. CEO characteristics also included whether someone had an MBA degree, law degree, tenure, what their age was, stock ownership, total pay, salary, and equity pay. He also made sure to include control variables: assets, age, tangibility, Tobin’s Q (the ratio between a physical asset’s market value and its replacement value), sales growth, leverage, stock return, and institutional ownership.

The researchers discovered that, on average, CEOs who invested primarily in R&D saw less immediate profit but had more long-term financial success than CEOs who invested little in R&D, according to He’s research. Investing in human capital was also determined as critical to a firm’s long-term success. He says these takeaways can offer solutions to new or struggling firms–especially during this unprecedented pandemic.

“I’m super honored, and so thankful, especially to the chair of my department and the dean of Paul College. They really care about everyone’s success,” He says. “I don’t have words to express how appreciative I am, so I’ll express it through my achievements.”

He is already generating buzz for her next project: research on the effect Gen-X directors have on a firm’s success. Over her career He has presented her research at prestigious conferences such as the Western Finance Association annual meetings, where she received a Ph.D. Candidate Award for Outstanding Research. He also was invited for a presentation by the Federal Reserve Bank of St. Louis on current developments and issues in community banking. Her work has been published in leading academic journals including the Journal of Financial and Quantitative Analysis, Journal of Corporate Finance and Review of Industrial Organization. Her research has received numerous awards such as the McGraw-Hill/Irwin Distinguished Paper Award and the Outstanding Doctoral Student Paper Award at the 2014 Southwestern Finance Association annual meetings, the Best Doctoral Student Paper Award at the 2015 Southern Finance Association annual meetings, and the best paper by a young scholar in the 2015 issues of Review of Industrial Organization.

Recently Selected Publications

Beracha, E., He, Z, Xi, Y. & Wintoki, M.B. (2021). On the Relation between Innovation and Housing Prices – A Metro Level Analysis of the US Market, Journal of Real Estate Finance and Economics.

He, Z., & Hirshleifer, D. A. (2020). The Exploratory Mindset and Corporate Innovation, Journal of Financial and Quantitative Analysis. • Outstanding Doctoral Student Paper Award at the Southern Finance Association, 2015

He, Z., & Ciccone, S. (2019). Too much liquidity? Seemingly excess cash for innovative firms. Financial Review, 55(1).

He, Z. (2018). Money Held for Moving Stars: Talent Competition and Corporate Cash Holdings, Journal of Corporate Finance, 51. • Max E. Fessler Dissertation Award, University of Kansas, 2015

-

Written By:

Krysten Godfrey Maddocks '96 | College of Liberal Arts | krysten.godfreymaddocks@unh.edu