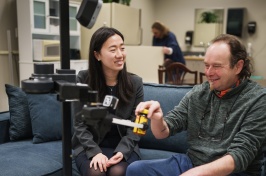

UNH Paul College students Aidan Kittredge and Kelsie Dawe with Professor Jeffrey Sohl

Forbes writer Geri Stengel recently penned a column on women venture capitalists and the challenges presented by Covid-19 as male VC's retreated to their habit of investing in male founders but not females. Stengel writes about associations and organizations that have developed programs to address the underreprsentation of women as venture capital decision-makers.

The focus of Stengel's column is The Rines Angel Fund, directed by Jeffrey Sohl, Paul College director of the Center for Venture Research and professor of entrepreneurship and decision sciences and funded by UNH donor Mel Rines. Sohl came up with the idea of a student-run angel investment fund. The Mel Rines '47 Student Angel Investment Fund is a $400,000 evergreen fund grounded in experiential learning. It is a cross-disciplinary undergraduate program that allows students to learn angel and venture capital investment strategies through the first-hand experience of investing in startups. Since it's inception in 2015, Rines has seen an increasing number of women apply to the program and this year 39% of associates and 80% of the executive committee were women.

-

Compiled By:

Sharon Keeler | Peter T. Paul College of Business and Economics | sharon.keeler@unh.edu | 6038623775