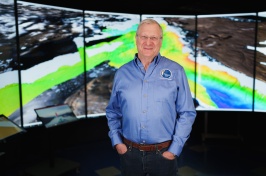

In research funded by the National Association of State Boards of Accountancy (NASBA) and reported in the Journal of Business Ethics, Professor of Accounting John Hasseldine and two co-authors recently explored the delicate balance accountants must strike in serving the public interest by experimentally examining potential tensions between these two ethical principles of integrity and client advocacy.

Certified Public Accountants (CPAs) in the United States and three million accountants globally must comply with a professional code of ethics. One core ethical principle, that of integrity, implies fair dealing, truthfulness, and honesty in all professional and business relationships.

At the same time, CPAs who provide tax advisory services must also act as client advocates for their public accounting clients — providing that their clients’ tax positions are within legal statutory bounds.

In research funded by the National Association of State Boards of Accountancy (NASBA) and reported in the Journal of Business Ethics, Professor of Accounting John Hasseldine and two co-authors recently explored the delicate balance accountants must strike in serving the public interest by experimentally examining potential tensions between these two ethical principles of integrity and client advocacy.

The experimental participants, made up of 132 CPAs from two large accounting firms, were each given an excerpt about either advocacy or integrity taken from their own CPA ethical code to read. Next, participants read a hypothetical land development tax case with clear-cut facts and asked whether the client would be taxed as a dealer, or as an investor, with respect to the sale of real estate lots. Although the case facts suggest the profit should have been taxed as ordinary income (dealer status), the client’s preference was clearly for the profit to be taxed as a capital gain (investor status) at a much lower tax rate.

“The results showed that the participants, in part, made different judgments and decisions contingent on whether they read the integrity ethical standard or the client advocacy standard they received,” Hasseldine explains. “The results have significant implications for professional accounting standard setters and accounting firms in general as they strive to balance commercial incentives with ethical decision making in accounting firms.”

The “big picture of tax” has interested Hasseldine for more than 30 years. He is an early pioneer of studying the costs of complying with tax laws and describes the entire tax reporting system, whether in the U.S. or elsewhere, as “an ethical environment at both the macro and micro level.”

At a macro level, governments must deal with the tax gap — the difference between what tax should be paid and what taxes are actually collected. While at Paul College, Hasseldine has addressed this issue by advising the International Monetary Fund on how to measure the tax gap for Value Added Tax — a tax on goods and services collected in some 150 countries around the world.

RECENT SELECTED PUBLIC ATIONS

Fatemi, D. & Hasseldine, J. (2019). Framing effects on preferences for the income tax system. Journal of Tax Administration, 5.

Hasseldine, J. & Fatemi, D. (2019). Tax practitioner judgements and client advocacy: the blurred boundary between capital gains vs. ordinary income. eJournal of Tax Research, 16.

Fatemi, D., Hasseldine, J., & Hite, P. (2018). The influence of ethical codes of conduct on professionalism in tax practice. Journal of Business Ethics.

Fatemi, D., Hasseldine, J., & Hite, P. (2018). The effect of professional standards on confirmation bias in tax decision making. eJournal of Tax Research, 16.

Hasseldine, J. & Morris, G. (2017). Unacceptable tax behaviour and corporate responsibility. In Epifantseva, Y., and Hashimzade, N. (Eds.) The Routledge Companion to Tax Avoidance Research. London: Routledge.

-

Written By:

Dave Moore | UNH Cooperative Extension