Faculty/Staff News

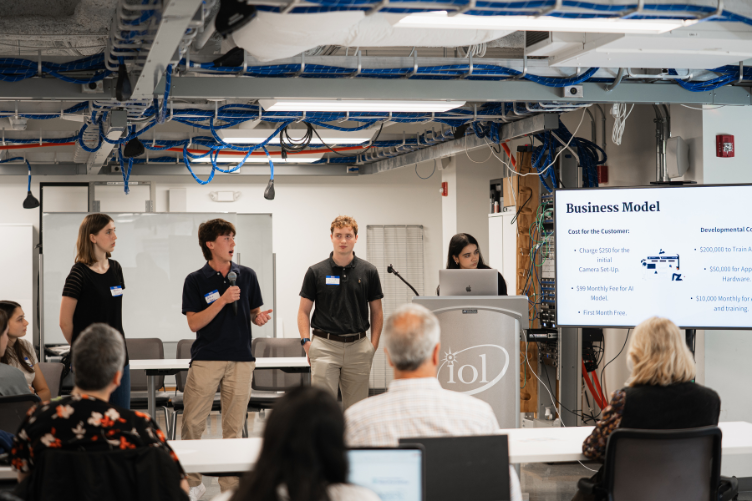

UNH’s ECenter Inspires the Next Generation of Entrepreneurs

UNH’s Entrepreneurship Center helps students from every major turn ideas into real ventures. From a medical literacy platform to award-winning startups, mentoring, competitions, and alumni support are fueling innovation campus-wide. Read More-

01/14/26

Planting, Picking, Weeding, and Record-Keeping

Even with years of experience and degrees in environmental horticulture and economics, Becky and Phil Brand still found themselves unsure of their... -

01/09/26

A Path Forward for a New Hampshire Town

Walking trails can serve multiple purposes, including economic development. In Barrington, UNH Extension staff are working with the town to create a... -

12/09/25

Mayer Receives Distinguished Professor Award for 2025

Get to know John (Jack) Mayer, the recipient of UNH's 2025 Distinguished Professor Award, given out during UNH's annual Faculty Excellence... -

11/21/25

Seeding the Future of the Forestry Industry

The forest industry has a workforce problem. UNH has partnered with industry associations to offer a solution.

Recent Stories

-

11/21/25 - American Institute of Chemical Engineers Honor Two UNH ResearchersTwo UNH researchers, Professor Harish Vashisth and postdoctoral research scholar Lev Levintov, in the Department of Chemical Engineering and Bioengineering have been honored by... Read More

-

11/20/25 - Karla Armenti Honored for Advancing Workplace Health and InclusionOn the heels of her retirement, Karla Armenti is being recognized for her career dedicated to improving workplace safety. More specifically, Armenti has been honored by the New... Read More

-

11/20/25 - UNH’s Dementia Care Robot Project Enters Home TestingUNH researchers have begun real-world testing of AI-enabled robot in the homes of families caring for loved ones with dementia, exploring how the technology can support... Read More

-

11/18/25 - For Older Adults Without Children, Friendship Can Be a LifelineUNH research finds older adults without children experience more loneliness, but strong friendships significantly reduce it. Marital status also matters, highlighting the... Read More

-

11/13/25 - Celebrating the Career and Retirement of Karla ArmentiHonoring a legacy of leadership, advocacy, and safer workplaces. Read More

-

11/12/25 - Master Gardeners Blossom at Spirit of NH AwardsThe annual Spirit of NH Awards on Oct. 27 honored several who had connections to UNH Extension's Master Gardener and Education Center Volunteer programs. Read More

-

11/10/25 - Faculty Excellence Celebration Recognizes Outstanding UNH EducatorsEvery year, a chosen few of UNH’s outstanding faculty members from each college and school receive Faculty Excellence Awards in recognition of their achievements in teaching,... Read More

-

10/28/25 - Keeping New Hampshire’s Outdoors Open and AccessibleUNH alum Ladd Raine ’06 is helping keep New Hampshire’s outdoors open, safe, and sustainable. As president of the Rumney Climbers Association, he leads volunteer efforts focused... Read More

-

10/14/25 - UNH Marketing Professor Turns Student Question into Global Business GuidebookUNH marketing professor Billur Akdeniz co-authored "International Marketing in a Changing World: A Managerial Guidebook," inspired by an MBA student who noted the lack of a single... Read More

-

10/14/25 - Urban Coast Institute Honors MayerLarry Mayer, professor and director of UNH’s Center for Coastal and Ocean Mapping, received the National Champion of the Ocean Award from the Urban Coast Institute (UCI) of... Read More